Embarking on the journey of starting a business is an exhilarating experience, filled with endless possibilities and the potential for success. However, amidst the excitement, it is crucial to recognize the significance of navigating the complex landscape of legal and regulatory requirements. While these obligations may initially seem daunting, understanding their importance can save entrepreneurs valuable time, money, and potential legal complications down the road.

This comprehensive guide aims to demystify the legal and regulatory considerations involved in establishing a business. By providing a clear roadmap and outlining the key steps involved, we strive to empower entrepreneurs with the knowledge and confidence needed to navigate this critical aspect of business formation. From choosing the right legal structure to obtaining necessary licenses and permits, complying with tax regulations, and protecting intellectual property, we will walk you through the essential elements of setting up your business legally.

Remember, by proactively addressing these legal and regulatory considerations, you are not only safeguarding your business but also laying a solid foundation for future growth and success. So, let's embark on this journey together and ensure that your entrepreneurial dreams are built on a strong legal framework.

Choosing the Right Business Structure

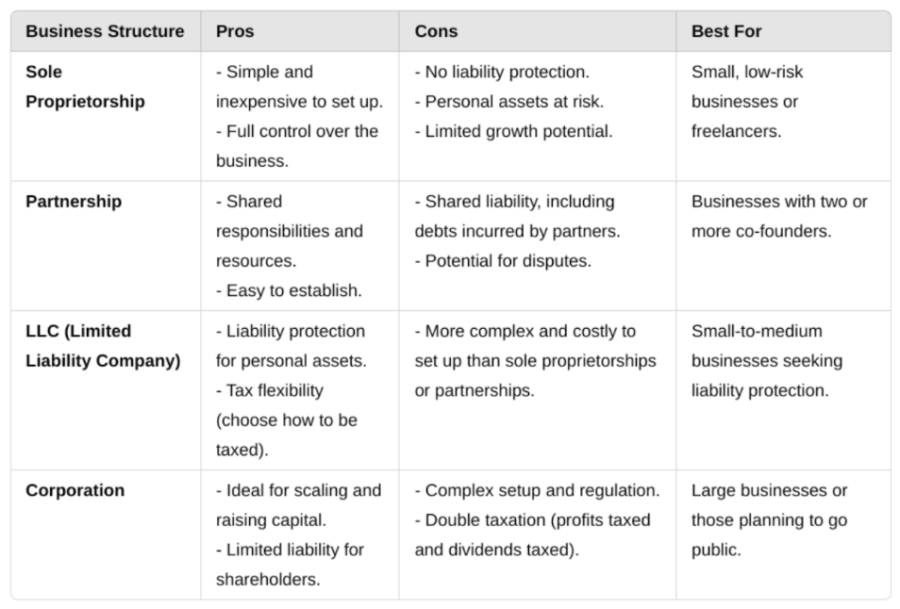

Choosing the right business structure is a critical decision that can shape the trajectory of your business. Your structure impacts how much you pay in taxes, the level of protection you have for personal assets, and the ease with which you can manage and grow your operations. For example, a sole proprietorship is great for simplicity and direct control, but it offers no liability protection. On the other hand, an LLC provides a safeguard for personal assets and flexibility in how you're taxed, making it a popular choice for small business owners. Understanding these nuances can help you align your choice with your long-term goals.

To determine the best structure for your business, start by considering your goals, size, and tolerance for risk. If you're running a small, low-risk operation, a sole proprietorship might make sense. But if you anticipate growth or operate in a high-liability industry, an LLC or corporation could provide the security and scalability you need. Think about whether you want to raise capital, how much control you want to retain, and your ability to navigate ongoing legal and administrative requirements. Consulting with a business attorney or accountant can provide clarity and help you make an informed decision that sets your business up for success.

Registering Your Business

When choosing a name for your business, it’s essential to ensure that it’s unique and meets state and federal naming requirements. Start by checking with your state’s business registry to confirm that the name you want isn’t already in use. It’s also a good idea to search for any trademarks associated with the name to avoid legal issues down the road. A well-chosen, compliant business name sets the foundation for building your brand and helps you avoid costly disputes later.

Another crucial step in starting your business is obtaining an EIN (Employer Identification Number). This number is issued by the IRS and is used for tax purposes, such as filing returns, opening a business bank account, and hiring employees. Applying for an EIN is straightforward and free — you can do it online through the IRS website in just a few minutes. Even if you don’t plan to hire employees right away, having an EIN helps separate your personal and business finances, making it a valuable tool for organization and professionalism.

Securing Licenses and Permits

Securing the necessary licenses and permits is a critical step for any small business owner, particularly for those operating in regulated industries like food service, healthcare, or construction. These requirements are designed to ensure businesses comply with local laws, protect public health and safety, and operate within designated zones. For example, health and safety permits are vital for restaurants to meet sanitation standards, while zoning permits ensure businesses are established in appropriate locations. Obtaining the right documentation not only prevents legal issues but also builds trust with customers and partners.

To determine which licenses and permits you need, start by consulting with local, state, and federal agencies. Each level of government may have its own set of regulations, and requirements can vary depending on your location and industry. Resources such as local chambers of commerce or small business development centers can also provide guidance. Taking the time to research and secure the proper permits upfront will save you headaches down the line and set your business on a solid legal foundation.

Understanding Tax Obligations

Securing the necessary licenses and permits is a critical step for any small business owner, particularly for those operating in regulated industries like food service, healthcare, or construction. These requirements are designed to ensure businesses comply with local laws, protect public health and safety, and operate within designated zones. For example, health and safety permits are vital for restaurants to meet sanitation standards, while zoning permits ensure businesses are established in appropriate locations. Obtaining the right documentation not only prevents legal issues but also builds trust with customers and partners.

To determine which licenses and permits you need, start by consulting with local, state, and federal agencies. Each level of government may have its own set of regulations, and requirements can vary depending on your location and industry. Resources such as local chambers of commerce or small business development centers can also provide guidance. Taking the time to research and secure the proper permits upfront will save you headaches down the line and set your business on a solid legal foundation.

Protecting Your Intellectual Property

Protecting your intellectual property (IP) is essential for safeguarding the unique aspects of your business, including your brand, products, and ideas. Intellectual property rights ensure that others cannot use, copy, or profit from your creations without permission, giving your business a competitive edge and reinforcing its identity. Whether it’s your logo, an innovative product, or original content like blog posts or artwork, securing IP rights helps establish ownership and prevents potential legal disputes down the road.

There are several ways to protect your intellectual property, depending on what you need to secure. Trademarks are used to safeguard brand identifiers such as logos, slogans, and business names, ensuring that no one else can use them in the same industry. Patents protect inventions, granting you exclusive rights to produce or sell your creation. Copyrights, on the other hand, apply to original works like written content, music, art, or designs, preventing unauthorized duplication or distribution. Taking the time to register your IP not only protects your business’s creative assets but also enhances its credibility and value.

Complying with Employment Laws

Complying with employment laws is a critical responsibility for any business hiring staff, as these laws are designed to protect both employers and employees. When hiring, it’s essential to follow labor regulations that cover minimum wage, overtime pay, workplace safety, and anti-discrimination rules. These laws vary by state and federal jurisdiction, so business owners must familiarize themselves with the specific requirements in their area. Failure to comply can result in costly penalties, lawsuits, or reputational damage. Ensuring fair treatment and adherence to these standards also fosters a positive work environment, which benefits employee morale and productivity.

Another important aspect of employment law compliance is understanding the distinction between employees and independent contractors. Employees are typically subject to payroll taxes, benefits, and labor protections, while contractors operate independently and handle their own taxes. Misclassifying workers can lead to legal and financial consequences, including back taxes and fines. To avoid these issues, clearly define roles, responsibilities, and work arrangements in contracts. Consulting with a legal or HR professional can help ensure your business is compliant and that your workforce is properly categorized.

Building Contracts and Agreements

Building contracts and agreements are essential for protecting business relationships and ensuring smooth operations. They serve as legally binding documents that outline the expectations, responsibilities, and rights of all parties involved. By clearly defining terms, contracts help prevent misunderstandings and disputes, reducing the risk of legal conflicts that could harm your business. Whether dealing with clients, vendors, or employees, having a well-structured agreement in place ensures that all parties understand their obligations, fostering trust and professionalism.

There are several types of business contracts, each serving a specific purpose. Client contracts establish the scope of work, payment terms, and deliverables, ensuring both parties have a clear understanding of their commitments. Vendor agreements define the terms of purchasing goods or services, protecting businesses from supply chain disruptions or unexpected costs. Employee agreements outline job roles, compensation, and workplace policies, helping to set clear expectations and prevent employment disputes. By implementing solid contracts, businesses can operate with confidence, reduce risks, and build strong, lasting relationships.

Getting Business Insurance

Business insurance is essential for protecting companies from financial risks such as property damage, liability claims, or employee injuries. It serves as a safety net, ensuring that unexpected events do not lead to significant financial losses or legal complications. By having the right coverage, businesses can operate with confidence, knowing they are prepared for potential setbacks.

There are several common types of business insurance. General liability insurance covers claims related to bodily injury, property damage, and legal fees. Professional liability insurance, also known as errors and omissions insurance, protects businesses against claims of negligence or mistakes in professional services. Workers' compensation insurance provides coverage for employee injuries, including medical expenses and lost wages. Choosing the right combination of these policies helps businesses safeguard their assets and maintain long-term stability.

Conclusion

Understanding legal and regulatory requirements is essential for building a successful business, though it can feel overwhelming. Compliance with laws helps protect your business from potential fines or legal issues.

Consulting a professional, such as a business attorney or accountant, can provide guidance and ensure you’re meeting all necessary regulations. Their expertise helps streamline the process and keeps your business on the right track.

In the comments section, share your experience with the legal side of your business!